ProShares Denies April 30 XRP ETF Launch Amid Misinformation Surge

29 April, 25 | After days of speculations on ProShares launch of XRP ETF’s the reality has finally come to the notice of all. In response to growing speculation, ProShares has officially clarified and denied the launching of any XRP exchange-traded funds (ETFs) on April 30, 2025. The statement comes after widespread misinformation, sparked by a misinterpreted regulatory filing, circulated across media outlets and social platforms.

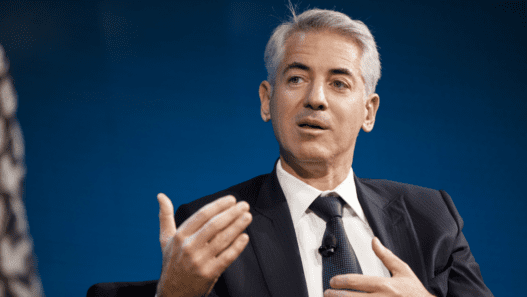

Bloomberg ETF analyst James Seyffart directly addressed the rumors, stating:

“We’ve confirmed that’s not the case. We don’t have a confirmed launch date yet, but we believe they will launch, likely in the short or possibly medium term.”

The confusion appears to have stemmed from an earlier SEC filing dated April 15, which was incorrectly interpreted as signaling an imminent launch. This misunderstanding led to inaccurate reporting and investor speculation across the crypto community.

What ProShares Has Planned

Despite the false start, ProShares does have concrete plans to roll out three XRP futures-based ETFs:

- Ultra XRP ETF : Offers 2x leveraged exposure to XRP futures

- Short XRP ETF : Provides -1x inverse exposure

- Ultra Short XRP ETF : Delivers -2x inverse exposure

These ETFs are designed to track XRP futures contracts, allowing investors to take positions on XRP’s price movements without directly holding the token.

Status with Regulators

The U.S. Securities and Exchange Commission (SEC) has already approved these futures-based products. However, ProShares is yet to announce a formal launch date. The firm has indicated that it anticipates the rollout in the short to medium term, pending further developments.

By contrast, spot XRP ETFs, which would involve direct holdings of XR, are still under review by the SEC. Applications from firms such as Grayscale, Bitwise, and Franklin Templeton remain pending, with key decisions to be expected later this year.

Market Reaction and Outlook

Despite the ETF delay, XRP’s market performance remains relatively stable. By the time of writing, XRP is trading at $2.29, down a modest 0.017% from the previous close, with intraday prices ranging between $2.26 and $2.34. Market activity and investor sentiment remain positive.

Investor Guidance

ProShares has emphasized that any updates regarding the launch of these ETFs will come through official channels. Investors are urged to avoid acting on unverified reports and to practice caution in navigating the rapidly evolving crypto ETF space.

This episode underscores the growing interest in regulated crypto investment products—and the critical need for clarity as institutional and retail investors await the next wave of ETF approvals.