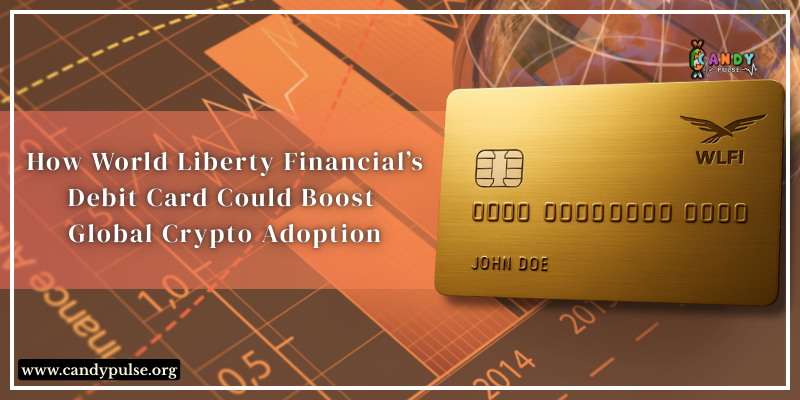

World Liberty Financial is gearing up to add another way we use crypto in everyday life. In recent events, co-founder, Zak Folkman, stated that the project is coming up with its own debit card very soon. This card will be backed by its stablecoin USD1, and will also have a user-friendly mobile application. This move is being seen to simplify the way crypto can be spent as easily as cash.

The core idea: Make USD1 spendable

WLFI has its own token and stablecoin. They are planning to bring their own exchange in the near future, so why did they suddenly decide to get a debit card and an app? The idea is simple: increase USD1 adoption.

This debit card is directly linked with USD1, this way it will be extremely easy for users to spend it as traditional currency. By having USD1 at the core of this development, the card will ensure that it is being converted into usable payment power, hence increasing adoption. This clever move will increase the status of the stablecoin from just a store of value to a lifestyle asset.

Execution strategy:

WLFI plans to get this product delivered on the pillars of accessibility and user-friendliness. It will be designed to provide a retail app experience that allows both peer-to-peer transfers and trading practices under one head. WLFI instead of developing its own closed chain is taking a smarter approach of being chain-agnostic. This way it will be able to ensure that its debit card and app remain compatible with multiple networks, hence adapting to crypto evolutions.

Another key factor that will play an important role in making this debit card a success is its integration with digital payment systems. Users will be able to connect their cards with their mobile wallets and use it similar to any other traditional card. A familiar interface will make it easy for novice and seasoned investors with a practical tool perfect for their assets.

What will be the broader implications?

The launch of a WLFI debit card will add to the user’s convenience. It will also shift USD1’s status from a trading asset to payment option. For individuals, it will simplify their crypto usability through a payment option that doesn’t require them to have special understanding of complicated conversions. For business, it will become easier to accept payment in crypto without making huge changes in their already existing payment systems.

The card’s global reach could be significant. It can emerge as a secure alternative for payments and cross-border transactions especially in the areas where traditional banking struggles to have access.

What are the challenges that lie ahead?

Even though WLFI offers a progressive outlook, its roadmap is not free of challenges. Above all, regulatory approval remains the most critical as it can play a decisive role in determining how quickly markets can adopt this card. Scaling of this card will also depend on which all markets it may cover, again relying on regulatory policies.

Crypto is often criticized for its pump and dump schemes and rug pulls, ensuring user protection and high security standards will also be essential. This factor will allow WLFI to get more traction while winning user confidence. Lastly, WLFI will face tough competition from both traditional fintechs and upcoming and established Web3 payment platforms.

The world is smoothly moving towards crypto adoption, and WLFI debit cards can play an important role in its framework by offering convenience along with robust security.

By making crypto usable in everyday life, WLFI will be able to set a stage for a more integrated financial future. The line between traditional finance and crypto innovation has begun to blur, and WLFI is leading its way.

SUMMARY

- WLFI has announced plans to come up with a debit card backed by its stablecoin USD1. This will be paired with a user-friendly app for payments, P2P transfers and trading.

- By linking USD1 with the app WLFI has smartly turned it from a store of value to a lifestyle asset making crypto as simple as using cash.

- This debit card will be compatible with mobile wallets ensuring seamless usability for both individuals and businesses.

- It can be a great way of boosting crypto adoption especially in underbanked regions.

FAQ

What is WLFI launching?

WLFI is planning to come up with a debit card along with its mobile app. Both card and app will be backed by its stablecoin USD1. This will make USD1 spendable like cash elevating its status from an asset to usability.

How will this card work?

This card will be chain-agnostic, meaning they are not locked with their one chain and can work across multiple blockchains. They are connected with digital wallets and can be used with pre-existing payment systems like any traditional debit card.