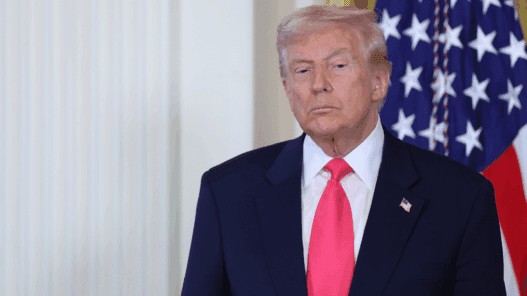

As tariff revenues surge, the White House is bracing for a Supreme Court ruling that could shape the future of President Donald Trump‘s trade agenda.

Tariff revenues climbed to a new high of $34.2 billion in October, raising the stakes as the Supreme Court considers whether the president can continue imposing broad duties without congressional approval.

TRUMP TARIFFS HAUL OVER $200B IN REVENUES AS SUPREME COURT WEIGHS CHALLENGE TO LEGALITY

Total duty revenue reached $215.2 billion in fiscal year 2025, which ended Sept. 30, according to the Treasury Department’s “Customs and Certain Excise Taxes” report.

So far in fiscal year 2026, which began on Oct. 1, the U.S. has collected $41.6 billion, according to the latest numbers published by the Treasury Department.

Since Trump announced his “Liberation Day” tariffs in April, tariff revenues have climbed sharply from $23.9 billion in May to $28 billion in June and $29 billion in July. That momentum continued through August and September, when the government collected a combined $62.6 billion in tariff revenue.

TRUMP SAYS TARIFF-FUNDED DIVIDEND PAYMENTS FOR AMERICANS WILL BEGIN NEXT YEAR

U.S. businesses pay these import taxes to the federal government, but they often recoup the cost by raising prices, meaning consumers end up footing much of the bill.

In response to growing concerns about affordability, Trump has begun lifting some tariffs in an effort to ease price pressures.

BESSENT DEFENDS TRUMP’S TARIFFS AGAINST CLAIMS THEY HARM US BUSINESSES

The president maintains, however, that aggressive tariffs are necessary to confront what he considers years of unfair global trade, a stance that shows how firmly trade policy is embedded in his broader economic strategy.

The president has also vowed that revenue generated from duties could fund a $2,000 dividend for low- and middle-income Americans.

TRUMP SAYS US HAS BEEN ‘THE KING OF BEING SCREWED’ BY TRADE IMBALANCE

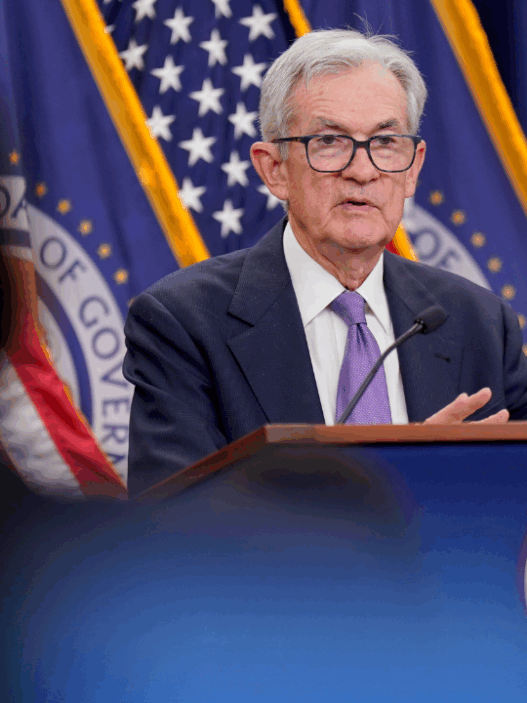

U.S. Trade Representative Jamieson Greer said Sunday that the potential one-time $2,000 payments are not expected to fuel inflation and could instead provide welcome relief to families.

Greer pushed back on concerns that the move might drive up prices, emphasizing that “this is not some kind of ongoing new welfare program or something that would exacerbate inflation.”

CLICK HERE TO GET FOX BUSINESS ON THE GO

He added that he expects American families will appreciate the checks. “But I don’t think it would change the overall macroeconomic picture,” Greer said.