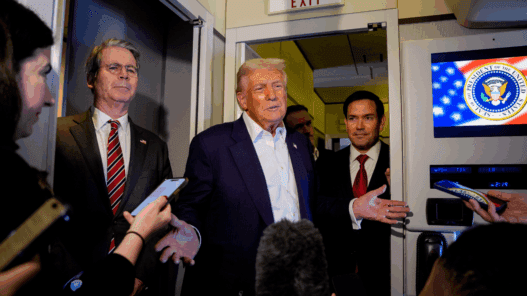

President Donald Trump said at a Cabinet meeting on Tuesday that American taxpayers are in line for record tax refunds when this year’s filing season opens in the next few months.

Trump said that the enactment of the One Big Beautiful Bill Act (OBBBA), which extended the tax cuts from the president’s first term that were due to expire at the end of this year and also contained other tax reforms and spending measures, will lead to taxpayers getting larger refunds.

“Next year’s projected to be the largest tax refund season ever,” Trump said.

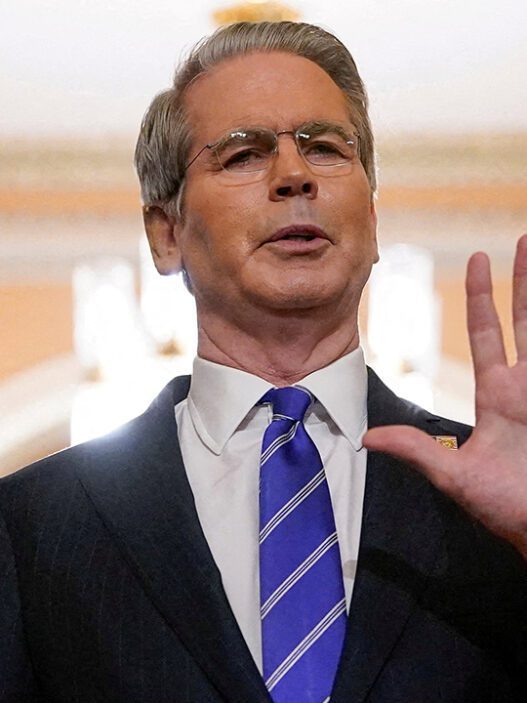

Treasury Secretary Scott Bessent said that the “best is yet to come” for the U.S. economy and noted that with many OBBBA provisions retroactive to this year, “in 2026 we are going to see very substantial tax refunds in the first quarter.”

TRUMP CALLS AFFORDABILITY ‘A DEMOCRAT SCAM’ AS INFLATION CONCERNS PERSIST NATIONWIDE

Bessent noted provisions such as tax relief for Social Security beneficiaries, workers who receive income from tips and overtime, as well as deducting auto loans for U.S.-made cars, can deliver financial relief for American taxpayers.

“The best way to address the affordability crisis is to give Americans more money in their pockets, which is what this bill has done. We’re going to see real wage increases, I think next year is going to be a fantastic year,” Bessent said.

Trump also doubled down on his pledge to give tariff dividends to Americans while he also said they would be used to reduce the national debt, adding that tariffs could eventually.

“We’re going to be giving back refunds out of the tariffs, because we’ve taken in literally trillions of dollars, and we’re going to be giving a nice dividend to the people, in addition to reducing the debt,” Trump said.

TRUMP’S $2K TARIFF DIVIDENDS COULD CARRY A HEFTY PRICE TAG

“I inherited a lot of debt, but it’s peanuts compared to the kind of numbers we’re talking about,” he added. “I believe that at some point in the not too distant future, you won’t even have income tax to pay because the money we’re taking in is so great, it’s so enormous that you’re not going to have income tax to pay, whether you get rid of it or just keep it around for fun or have it really low, much lower than it is now, but you won’t be paying income tax.”

Trump has previously proposed giving $2,000 tariff dividends to Americans who are low- or middle-income, though Congress would likely need to enact legislation permitting the dividend payments to proceed. The president has said they’re looking at paying out the dividends in mid-2026.

The nonpartisan Committee for a Responsible Federal Budget (CRFB) estimated that if Trump’s tariff dividends are structured like the COVID-19 era stimulus payments that went to adults and children after accounting for income levels, each round of tariff payments would cost about $600 billion on an annual basis.

The CRFB noted that the tariffs put in place by the Trump administration have raised about $100 billion so far this year, including tariffs that were ruled illegal by federal courts are pending an appeal before the Supreme Court.

TRADERS BET SUPREME COURT WON’T BACK TRUMP ON TARIFFS, DIMMING REBATE HOPES

On an annual basis, the Trump administration’s tariffs – including those that may be struck down by the Supreme Court – are projected to raise about $300 billion per year. By contrast, the net new tariff revenue that isn’t subject to the Supreme Court ruling raises a little less than $100 billion per year.

The CRFB said that if $2,000 dividends were paid annually, they would increase the debt by $6 trillion over 10 years, adding that the cost is “roughly twice as much as President Trump’s tariffs are estimated to raise over the same time period.”

Tariff revenue is a relatively small portion of overall federal tax revenue. In fiscal year 2025, which ended in September, individual income taxes generated about $2.656 trillion in tax revenue while payroll taxes tacked on $1.748 trillion and corporate income taxes a further $452 billion.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

By contrast, customs duties including tariffs brought in just $195 billion in revenue in FY2025, representing about 3.7% of total tax receipts for the year.