The reconciliation bill working its way through Congress would eliminate the electric vehicle tax credit created under the Inflation Reduction Act. The removal of the credit, created to incentivize U.S. consumers to purchase electrified vehicles, would likely lead to a drop in EV sales and production. However, Tesla sales would likely remain largely unaffected, one expert predicts.

“Getting rid of this $7,500 tax credit should not impact [Tesla] sales,” automotive expert Lauren Fix told FOX Business. “People buy Teslas because they like the product… They know what their customers want, and those that like Teslas will continue to purchase that product.”

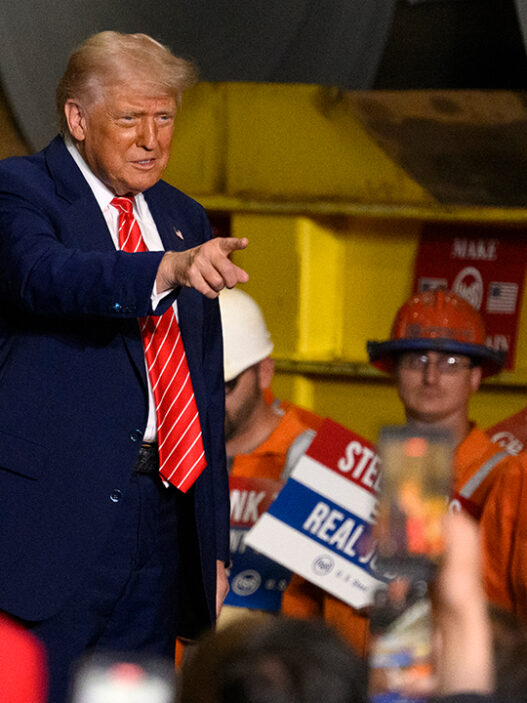

The “One Big Beautiful Bill Act” was approved by the House on May 22 in a 215-214 vote. If the measure passes the Senate and is signed into law by President Donald Trump, the $7,500 new-vehicle tax credit and $4,000 used-vehicle tax credit incentives on EVs would be killed, along with subsidies for battery manufacturing, the text of the bill says. The EV tax credit, which started during the Obama administration, is set to expire on Dec. 31, 2032. The new provision “accelerates the expiration to December 31, 2025.”

TRUMP TEAM REPORTEDLY LOOKING TO KILL BIDEN’S $7,500 EV TAX CREDIT

Ending the clean vehicle tax credit would result in a sharp decrease in EV sales in the U.S., Fix said.

“Once that tax credit goes away, I’m expecting [electric vehicles] to be about 2% of sales,” Fix said, noting that EVs currently account for around 8% of total car sales in the U.S. “There will still be electric vehicle sales, Tesla will still survive and [Elon Musk] will do well. And other brands will make what consumers want.”

FEDERAL EV TAX CREDIT SLASHED IN HALF FOR SOME TESLA MODEL 3S IN 2024

Tesla, the leading EV manufacturer in the U.S., has focused more on selling carbon credits to other automakers than it has on consumer tax incentives. The company, which has moved the bulk of its production to Texas, has also become “more efficient and effective” in its manufacturing, according to Fix.

“What Tesla has done, and they don’t really care about the $7,500 tax credit, is they were selling carbon credits to all the other car manufacturers,” Fix said. “That’s where they’ve made their profits.”

TRUMP WANTS TO ROLL BACK BIDEN’S EV PUSH: HERE IS HOW IT WOULD AFFECT CONSUMERS

Meanwhile, other leading EV automakers like Hyundai and Ford may decide to reduce production of electrified vehicles if the One Big Beautiful Bill Act is signed into law, she said.

“You’re going to see their production quantities drop dramatically,” Fix said. “The only reason the manufacturers are building electric vehicles to begin with is because they were mandated to do so.”

Trump in January issued an executive order to “eliminate the electric vehicle mandate and promote true consumer choice.”

CLICK HERE TO GET FOX BUSINESS ON THE GO

Tesla, Hyundai and Ford Motor Company did not immediately respond to Fox Business’ request for comment.