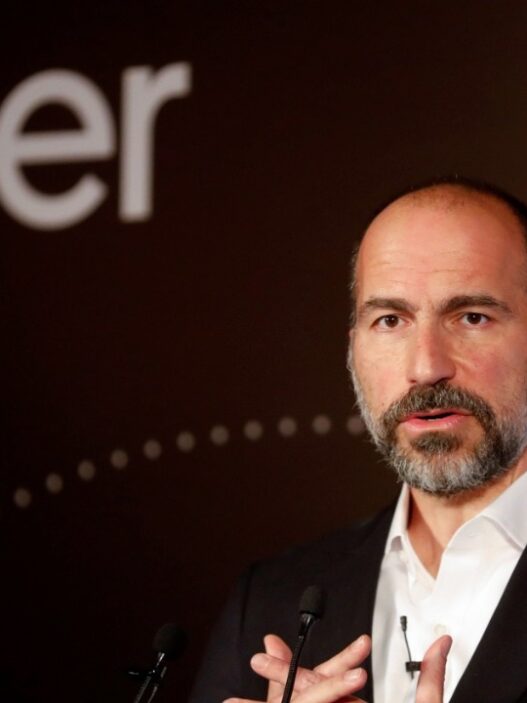

SEC Chairman Paul Atkins said rapid advances in electronic trading and blockchain technology are driving the biggest transformation in the U.S. financial system in decades, predicting that tokenization could become a core feature of American markets in just a few years.

“The next step is coming with digital assets and digitization, tokenization of the market,” Atkins told FOX Business’ Maria Bartiromo, adding that the shift could happen faster than many expect.

“It’s the way the world will be… maybe not even in ten years, maybe even a lot less time, maybe a couple of years from now.”

DIGITAL ASSETS GROUP OUTLINES BLOCKCHAIN POLICY GOALS

In an exclusive interview on “Mornings with Maria” on Wednesday, Atkins was optimistic that tokenization will bring “huge benefits” like greater predictability and transparency, noting that on-chain settlement could eventually reduce risk by narrowing or eliminating the traditional gap between trade execution, payment and final settlement.

He added that the shift comes as regulators rethink their approach to digital assets.

“The trouble that we’ve seen here over the past few years is that the SEC historically was never necessarily at the vanguard of pushing new innovations. It was always a little bit behind the market,” Atkins said.

TRUMP VOWS TO MAKE US ‘UNDISPUTED BITCOIN SUPERPOWER AND CRYPTO CAPITAL OF THE WORLD’

“But here recently, it’s been almost standing athwart [in] the marketplace as all these new innovations were coming about… We’re actually embracing it, and I believe that we need to be embracing it to keep the United States at the forefront as far as cryptocurrencies and whatnot.”

Atkins noted that the U.S. is now taking a markedly different posture toward digital assets than it did just a few years ago, saying the U.S. and Communist China had been “the only two countries” moving to make cryptocurrencies illegal.

“It’s a new day now, and so we want to embrace this new technology, bring it onshore where it can work under American rules,” he said.

“And with the implosion of FTX offshore, LedgerX didn’t skip a beat. All the customer assets were accounted for because they had segregated accounts under CFTC rules. And so that was, I think, a good example of good regulations that protected investors.”