The White House is set to launch a sweeping new savings initiative for children on Tuesday, unveiling President Donald Trump’s “Trump accounts” program alongside a multi-billion dollar pledge from Michael and Susan Dell — the effort’s first major dose of private funding.

“The One Big Beautiful Bill’s Trump Accounts are a revolutionary investment by the federal government into the next generation of American children,” White House spokesman Kush Desai told Fox News Digital.

“It’s also President Trump’s call to action for American businesses and philanthropists to do their part, too – Michael and Susan Dell’s $6 billion investment into America’s children is the first of many announcements to come for America’s children.”

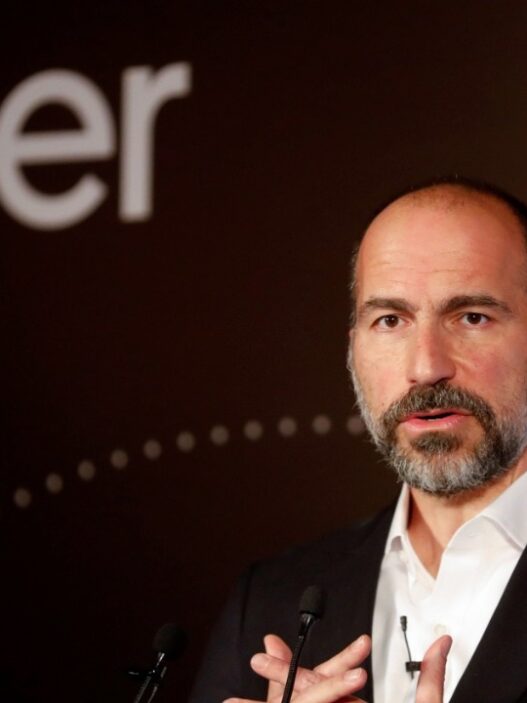

MICHAEL AND SUSAN DELL DONATE $6.25B TO FUND ‘TRUMP ACCOUNTS’

Michael Dell, founder and CEO of Dell Technologies, and his wife, Susan, announced an investment of $6.25 billion on Tuesday for the “Trump accounts.”

“These investment accounts are simple, secure, and structured to grow in value through market returns over time. At age 18, these young Americans can have a financial foundation for continued education, job training, home ownership, or future savings. It’s a simple yet very powerful idea,” the couple wrote in a statement.

‘TRUMP ACCOUNTS’ FOR NEWBORNS COULD GROW TO $1.9M, TREASURY SAYS

The new savings program, tucked into the One Big Beautiful Bill Act and signed into law by Trump on July 4, provides every child born between Jan. 1, 2025 and Dec. 31, 2028 with a one-time $1,000 government deposit at birth.

Families are eligible to open an account once their child has a Social Security number, and the money must remain untouched until the child reaches age 18.

HOW THE ‘BIG, BEAUTIFUL BILL’ GIVES AMERICAN BABIES A FINANCIAL HEAD START

Parents and other relatives can contribute up to $5,000 each year, with the limit subject to possible inflation adjustments after 2027.

And those contributions can add up quickly.

Treasury estimates indicate that the “Trump accounts” could accumulate into a seven-figure balance by early adulthood if families maximize contributions and allow the funds to grow.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

A fully funded account could reach as much as $1.9 million by age 28, according to the Treasury’s Office of Tax Analysis. Even at the lower end of projected returns, the savings account could still yield nearly $600,000 over the same period.

Even without additional contributions beyond the federal government’s initial $1,000 deposit, Treasury estimates the account could grow to between $3,000 and $13,800 over 18 years.