Digital assets are slowly changing the perception of their role in the global financial landscape. Something that started as a retail-oriented process has entered the institutional domain with leading firms taking interest in them while allocating their capital to Bitcoin and Ethereum as part of their reserves.

Asset managers like BlackRock and corporate leaders like Michael Saylor have turned them into a serious investment strategy for reserve assets. As more and more institutions pour in their interest in crypto, it is becoming clear that digital assets are moving at a fast pace, making their way in the broader market ecosystem.

Bitcoin – The Digital Gold

It all started with Bitcoin. With a fixed supply of 21 million coins and decentralized architecture, it consistently earned its place as the most valuable digital asset. It has been termed ‘the digital gold’ and unlike gold in the traditional market, it acts as a hedge against inflation.

In contrast to fiat currencies that work as per central bank policies and deal with inflation pressures, Bitcoin offers decentralization. This property makes it appealing for institutions as they prefer diversifying their reserves while being protected against monetary decline.

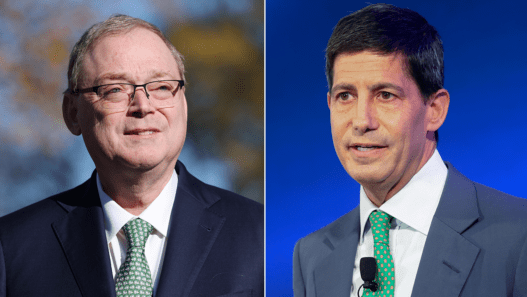

Michael Saylor, Executive Chairman of MicroStrategy, has been extremely vocal about holding Bitcoin on the balance sheet. Not only does he advise investing in Bitcoin, he acts on it too pioneering in Bitcoin adoption. His company’s decision of keeping Bitcoin as a reserve is based on the thesis that one day Bitcoin will outperform traditional assets. He firmly believes that Bitcoin is a store of value and a superior treasury asset

Ethereum – The Foundation of Tokenization

While Bitcoin is prized for its stability and rarity, Ethereum provides institutions with something else: utility. As the foundation of DeFi, tokenization, and smart contracts, Ethereum has established itself as the core layer of the digital economy.

Ethereum’s future scaling solutions and its proof-of-stake framework provide it with an energy-efficient advantage. This makes it more attractive to investors concerned about environmental sustainability. To institutions, Ethereum offers exposure to price gains along with the ecosystem of innovation that is transforming financial services, supply chains, and even identity systems.

BlackRock’s Strategic Approach

As the biggest asset manager in the world, BlackRock has cemented the institutional use case for digital assets. The introduction of spot Bitcoin ETFs and additional financial products based on Ethereum show the first major evidence of crypto moving from the remote fringes of finance to the mainstream.

Larry Fink, BlackRock’s CEO, has even stated publicly, “Tokenization is the future of capital markets”, explaining that Ethereum will help to reduce settlement time and create efficiencies. Institutions are keen to reduce costs and increase transparency and openness, and employing the efficiencies of Ethereum is an example of this.

Diversification and Risk Management

For institutions, there is also a risk management aspect to utilizing Bitcoin and/or Ethereum in reserve allocations. Both assets are low-correlation to traditional equities/bonds and thus help on the diversification side of the risk equation. Unprecedented volatility in the macro environment and concentrated risk in traditional financial instruments mean that exposure to some assets that function differently than traditional financial instruments is an incentive to continue to manage risk.

Further, directly allocating bitcoin and/or ethereum to reserves is a signal of confidence to the rest of the market. It is a declaration that not only marks a bridge with traditional finance, but also embraces some innovation while extending a hedge against capital markets’ traditional structural tension.

The Bigger Picture

The use of Bitcoin and Ethereum as reserve assets by large institutions shall not be considered as just a passing trend. It is in fact a capital management evolution in strategy. Bitcoin offers scarcity and a decentralized store of value, whereas Ethereum provides innovation and infrastructure. Together, they complement each other while build the future of finance

BlackRock and Saylor’s moves reflect a larger acknowledgment: digital assets are no longer speculative periphery but fundamental tools for wealth growth and protection in a world of digitization.