The difference between the US and EU approaches to crypto has become evident as the European Central Bank (ECB) is building a blockchain system to process CBDC (Central Bank Digital Currency) transactions.

ECB President Christine Lagarde also nixed the idea of a European Bitcoin reserve due to $BTC’s volatility and frequent use in illicit activities (which isn’t entirely true–criminals prefer cash to crypto).

In contrast, President Trump and Fed Chair Jerome Powell are strictly against CBDCs, and 20 US states have proposed establishing crypto reserves (cries in European).

Let’s unpack what the EU’s anti-crypto stance means for the market.

Inside the ECB’s CBDC Plan

The launch of an EU-wide blockchain payment system is the first step toward rolling out a fully functioning wholesale CBDC, the digital euro.

This system will be compatible with TARGET Services, a platform that currently handles large-value payments, securities settlement, and instant payments across Europe.

After integrating the new system with TARGET, the ECB will focus on its interoperability with foreign CBDC infrastructures for exchange settlements.

ECB Board member Piero Cipollone deems this innovation, but European crypto investors would likely call it an attempt at surveillance.

ECB Is Against Crypto Reserves, Czech Republic Feels Rebellious

The ECB also disapproved of the Czech National Bank’s plan to allocate 5% of its reserves to $BTC purchases.

CNB Governor Aleš Michl argued he used to run an investment fund and ‘likes profitability,’ which suggests the Czech Republic might soon set a precedent for other EU countries.

It’s clear that the EU prioritizes safety and stability over individual freedoms and technological development.

However, this might change when multiple US states create crypto reserves, particularly if they prove this strategy to be fruitful. Non-eurozone countries like the Czech Republic would be the first to go against the tide, and others could follow suit.

When this happens, $BTC will rally to new heights due to broader adoption and legitimacy.

BTC Bull Token ($BTCBULL) Celebrates Crypto’s Historic Rally With $BTC Airdrops

While government officials remain cautious, retail investors can go for riskier opportunities like new meme coins on presale that might yield greater returns.

But not all new crypto have an equal chance in this bull run.

BTC Bull Token ($BTCBULL) is the only meme coin closely linked to $BTC. It supports the OG crypto on its way to $250K with regular $BTC airdrops.

All you need to get free $BTC is to buy $BTCBULL, hold it in Best Wallet, and wait for the world’s first crypto to hit $150K and $200K.

When $BTC reaches $250K, the project will reward its loyal holders with a massive $BTCBULL token airdrop.

$BTCBULL’s deflationary tokenomics model aims to support the token’s upward price action after launch. Whenever $BTC hits $125K, $175K, and $225K, the project will permanently remove a part of the tokens for circulation to create scarcity and drive demand.

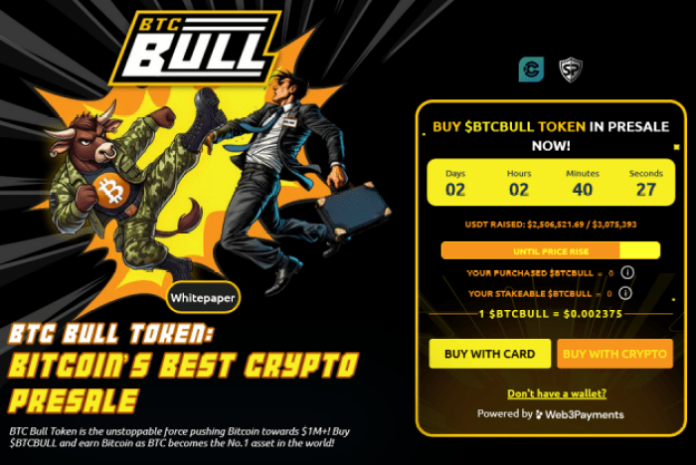

$BTCBULL’s presale kicked off on February 11 and has since raised $2.5M. One token now costs $0.002375, but the price is increasing fast as the project progresses toward new fundraising milestones.

This means now is the time to take the bull by the horns and secure your share of $BTCBULL before everyone else does. Early adopters also benefit from a 172% APY, set to decrease as the staking pool expands.

Final Remarks

We aren’t just watching a battle of regulations–we’re watching two different philosophies play out in real time. While the US says, ‘let’s give crypto a shot,’ the EU is giving it a cold shoulder.

This doesn’t mean that the ECB is entirely against innovation, though. Its blockchain-based payment system could also support crypto like $BTC and altcoins in the future if the US and Czech Republic lead by example.

Institutional adoption will fuel this year’s $BTC rally, and $BTCBULL has positioned itself to capture investor appetite.

However, remember the old-school Wall Street saying: bulls make money, bears make money, pigs get slaughtered. Don’t get greedy–DYOR, diversify your portfolio, and only invest as much as you can afford to lose.